Gold as a hedge against inflation

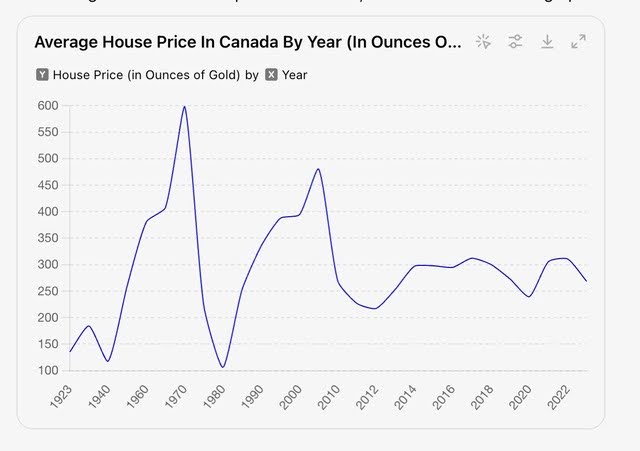

1923-2002 – House Prices in Oz of Gold

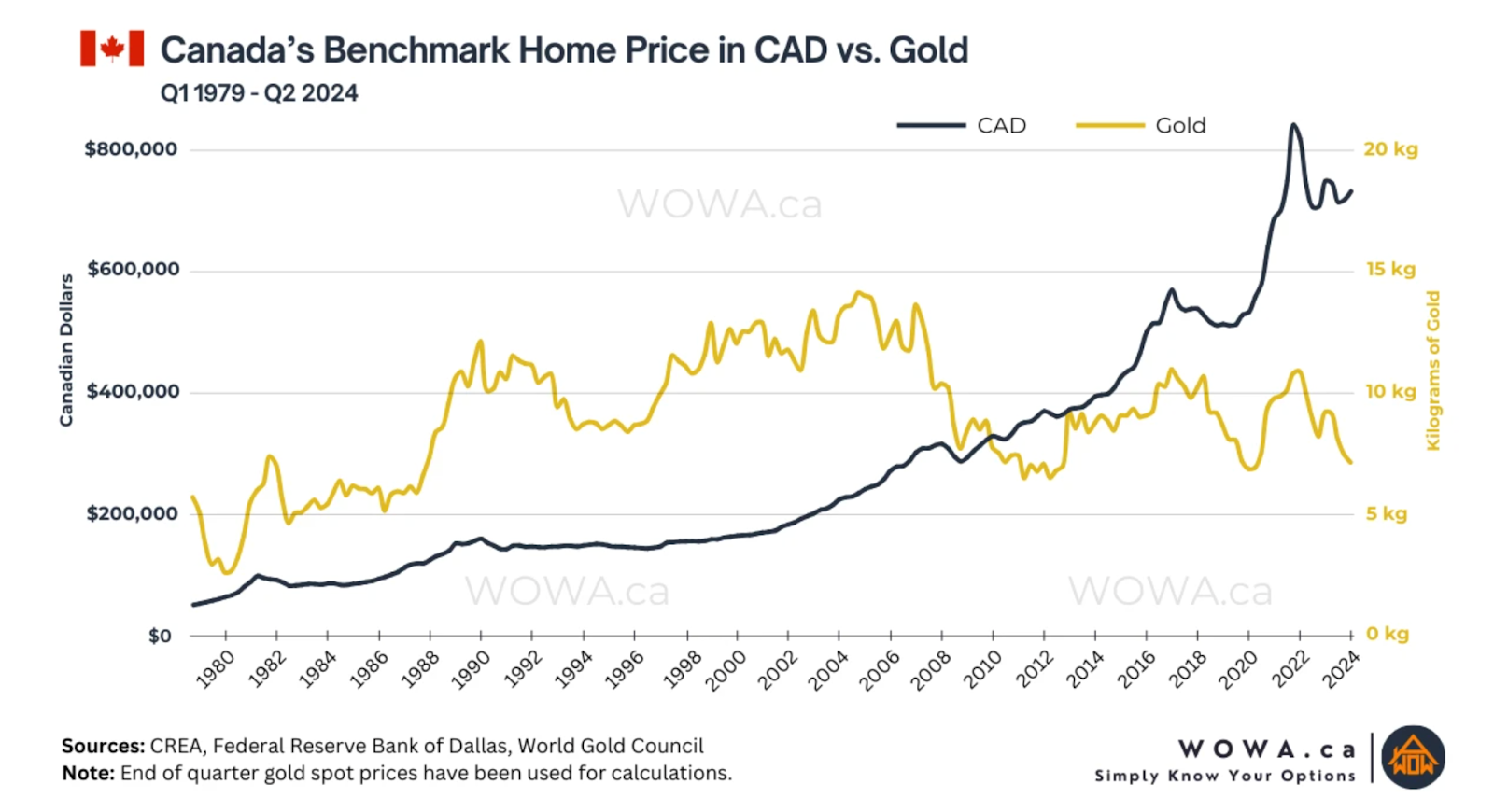

1980-2024 – House Prices in Kg of Gold

When people talk about gold as a hedge against inflation, it can sound abstract. Prices rise. Currencies change. Charts go up and down. But one of the clearest ways to understand gold’s long-term role is to compare it to something most Canadians think about regularly: housing.

Instead of asking how much a house costs in dollars, we can ask a different question.

How much gold does it take to buy an average Canadian home?

When you look at that comparison over time, an interesting pattern begins to emerge.

Canada’s Average House Price in 2025

In 2025, the average price of a single-family home in Canada was approximately $738,000.

Over that same year, gold averaged roughly $4,800 per ounce.

Based on those figures, it would take about 150 ounces of gold to buy the average single-family Canadian home today.

That works out to just under five kilograms of gold, or roughly five standard one-kilogram gold bars.

This gives us a clear, modern reference point. Now let’s look backward.

Canada’s Average House Price in 1925

In 1925, a typical Canadian home cost about $5,000.

At the time, gold was priced at roughly $20.67 per ounce under the gold standard.

That means it would have taken around 240 ounces of gold to buy a Canadian home in 1925.

That works out to a bit more than seven kilograms of gold to buy a Canadian home in 1925.

Despite a century of economic change, population growth, wars, technological advances and inflation, housing costs measured in gold remain within the same general order of magnitude over very long time horizons. Prices expressed in currency changed dramatically, while prices expressed in gold moved far less.

What This Tells Us About Inflation

Inflation reduces the purchasing power of currency over time. A dollar today does not buy what it did decades ago.

Gold behaves differently.

Rather than increasing in value in a straight line, gold has historically maintained purchasing power across long time horizons. As currencies weaken or prices rise, gold often adjusts accordingly.

This does not mean gold moves smoothly in the short term. Prices can be volatile, and timing matters for traders. But when viewed over generations rather than months or years, gold has shown a strong ability to preserve value.

Gold Is Not About Getting Rich Quickly

It is important to be clear about what gold is and is not.

Gold is not a growth asset in the same way stocks or real estate can be. It does not generate income, and it does not compound.

Gold is about preservation.

For many Canadians, gold plays a role as:

- A hedge against inflation

- A way to diversify savings

- A long-term store of value

- A tangible asset outside the financial system

The housing comparison helps illustrate this role in a practical, real-world way.

Why This Matters Today

Housing affordability is a major concern across Canada. Prices often feel disconnected from wages and long-term savings. At the same time, inflation has led many people to rethink how they protect the value of their money.

Looking at gold through the lens of housing reminds us that while prices change, purchasing power matters more than raw numbers.

Gold has helped preserve purchasing power across decades of economic change. That is why it continues to be part of long-term planning conversations for individuals, families and institutions alike.

What We’re Seeing at Canada Gold

At Canada Gold, we are also seeing a shift in how younger Canadians think about building a future. Many know that buying a home outright is not realistic for them right now. Instead of waiting on the sidelines, they are choosing to start smaller.

We see younger customers purchasing fractional gold, silver and other precious metals as a way to begin building long-term value in a tangible, disciplined way. While precious metals are not a shortcut to homeownership, they can play a role in preserving purchasing power, developing healthy saving habits and creating optionality for the future.

For many, it is about taking a first step rather than trying to make a single, life-changing move all at once.

A Simple Takeaway

One hundred years ago, it took roughly 240 ounces of gold to buy a Canadian home.

Today, it takes roughly 150 ounces of gold to buy a Canadian home.

Currencies change. Prices rise. Gold has largely held its ground.

If you are thinking about gold as part of your long-term financial picture, understanding its historical role can help you make more informed decisions.

A Note on Data and Sources

Historical housing and gold pricing data can be difficult to standardize, particularly for the early 20th century. Canada did not publish consistent national housing averages in the 1920s, and many figures from that period are drawn from preserved records, academic research and historical price estimates rather than modern market reporting.

Gold pricing data for the 1920s reflects the gold standard era, when the Canadian and U.S. dollars traded at or near parity and gold prices were fixed. Modern housing and gold figures are based on Canadian market data and publicly available price averages.

All comparisons in this article are intended to illustrate long-term purchasing power and broad historical patterns, rather than precise point-in-time valuations.

Interested in learning more about gold or seeing current pricing?

Visit your local Canada Gold location or explore our educational resources to learn how precious metals may fit into your goals.